ev charger tax credit 2020

For example the New York State Department of Taxation and Finance offers an income tax credit of 50 of the cost of EV charging infrastructure up to 5000 through the alternative fuels and electric vehicle recharging property credit. For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure.

What S In The White House Plan To Expand Electric Car Charging Network Npr

Businesses and Self Employed.

. Just buy and install by December 31 2021 then claim the credit on your federal tax return. Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000. The tax credit now expires on December 31 2021.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Try entering a car credit of 7500 and a charger total cost of 100000 and see what you get.

For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure. Carpool lane access and reduced rates for electric vehicle charging. Sales of 2022 of Electric Vehicles continues go grow.

However I cant find any evidence of this being valid past 123121. Grab IRS form 8911 or use our handy guide to get your credit. Eligible alternative fuels include natural gas propane and electricity.

A battery-electric vehicle BEV with a rating of 25 kWh per 100 miles costs approximately 375 dollars per year or 3125 per month to charge at a rate of 10 cents per kWh. EV Charging Incentives by State. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car.

Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. State tax credit equal to the lesser of 35 of actual. The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience.

President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. Permitting and inspection fees are not included in covered expenses.

Eligible alternative fuels include natural gas propane and electricity. Please ask someone with authority to fix the software. Here are the currently available eligible vehicles.

The credit amount will vary based on the capacity of the battery used to power the. Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31 2021 is eligible for a tax credit of 30 of the cost not to exceed 30000. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021.

Federal Tax Credit Up To 7500. You must have purchased it. The full phase-out already occurred for GMs Chevrolet Bolt Volt and Cadillac CT6 Plug-in and ELR for example with these EVs becoming ineligible for the credit after the end of March 2020.

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. You may be eligible for a credit under Section 30D a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

State-based EV charger tax credits and incentive programs vary widely from state to state. You might have heard that the federal tax credit for EV charging stations was reintroduced recently. In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020.

2020 provided a two-year extension of the Investment Tax Credit for solar. It covers 30 of the costs with a maximum 1000. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate.

Earned Income Tax Credit. The Alternative Fuel Vehicle Refueling Property Tax Credit or 2020 30C Tax Credit provides tax relief for businesses that install refueling properties such as EV charging stations and applies retroactively to any costs associated. The new bill would look to reinstate up to 7000 in tax credits for these EVs.

Federal EV Charger Incentives. I would love to see a copy of you schedule 3 showing 7800 in total credit. You have a sub-routine which limits the total amount contrary to the law.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The Alternative Fuel Vehicle Refueling Property Tax Credit or 2020 30C Tax Credit provides tax relief for businesses that install refueling properties such as EV charging stations and applies retroactively to any costs associated with.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

Commercial Ev Charging Incentives In 2022 Revision Energy

How To Choose The Right Ev Charger For You Forbes Wheels

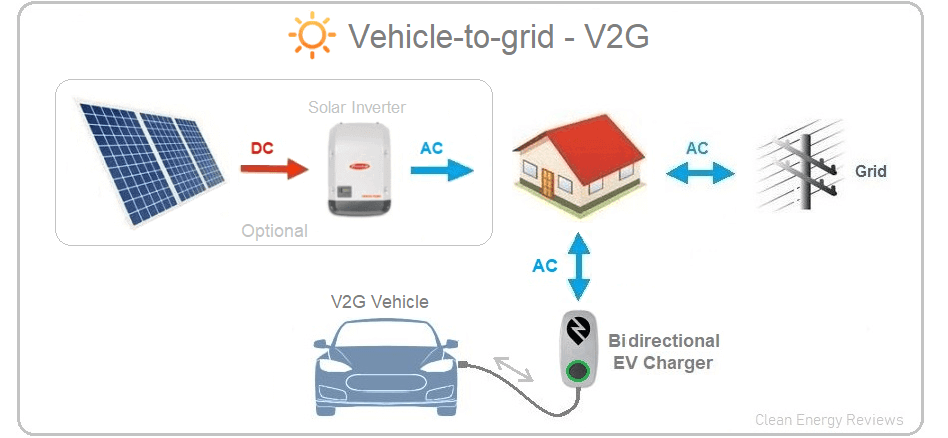

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

How To Choose The Right Ev Charger For You Forbes Wheels

Zero Emission Vehicle Charging Stations

10 Must Read Ev Charger Installations Faq Home Ev Charger Install Sun Electrical In Calgary

Edmonton Electric Vehicle Ev Charging Rebate Program

Tax Credit For Electric Vehicle Chargers Enel X

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Rebates And Tax Credits For Electric Vehicle Charging Stations

2022 Cost Of Electric Car Charging Station Installation Level 2 3 Homeadvisor

Your Guide To Electric Vehicle Ev Charging At Home

2022 Ev Charging Stations Cost Install Level 2 Or Tesla

Charging Nissan Leaf Leaf E Plus Range Charging Time Type How Much Does It Cost To Charge E Mobility Simplifi Nissan Leaf Nissan Nissan Leaf Charging

Buy Chargepoint Home Flex Chargepoint

How To Claim An Electric Vehicle Tax Credit Enel X

Electric Car Makers Have Big Plans For Wireless Ev Charging Plugless